Please find attached some comments on where we think the markets will go in Q2 2014. Information is from a variety of sources including suppliers. These are just indications rather than exact predictions.

If you have any comments or we can help with anything else, please let us know.

Methanol:

The Northwest European Methanol contract price for Q2 2014 was settled late last week, down €33/mt from Q1 2014. Producers had clearly been hoping to keep prices at a high for a further quarter, whilst the dramatic fall in prices in Asia caused European spot prices to fall heavily in recent weeks, so consumers were clearly hoping for an even bigger reduction in the contract price. Current prices are still among the highest in the last 5 years and the market will depend on what happens globally over the next quarter. Demand in Europe is reasonably buoyant but stable. If Europe attracts cargoes from Asia plus a restart of Iranian material into EU ports then there could be further and larger corrections in Q3.

Acetic Acid & Acetyls

The fall in methanol prices has been counterbalanced with an increase in natural gas prices and consequently producers have increased the Acetic Acid price by €20 per tonne for Q2 2014.

VAM: European VAM has hit record highs due to extreme tightness in the market. There has been force majeure announcements at some US plants coupled with in Spain and UK. This will add further pressure to VAM prices during 2014

Ethanol:

There have been some downwards movements in the Ethylene contract price during Q1 and into Q2 2014. Producers have applied these decreases on other ethylene based derivatives but Ethanol is expected to remain stable for Q2 2014. Many US producers have cut production rates or idled plants as a result of higher feedstock costs (corn) and this will result in higher Ethanol prices in the US. High quality synthetic material remains tight and this situation will continue through 2014-15. INEOS acquisition of Sasol Solvents Germany GmbH is going through the competition authorities in Europe. This acquisition involves the following products: Isopropyl alcohol (IPA), secondary Butyl alcohol (SBA), Methyl ethyl ketone (MEK) and Ethanol. The acquisition is expected to be finalised towards the end of Q2

Ethyl Acetate:

Even though Europe is structurally short on Ethyl Acetate, as it is limited to only one major local producer, regular imports were expected to continue from Mexico, India and Brazil and keep the market balanced. However imports from India have declined in recent weeks leading to tightness in the market and producers are only supplying contracted customers. Consequently prices have begun to increase although these prices may attract extra volumes into Europe, thereby mitigating these recent increases. Market is expected to fluctuate up and down during the course of Q2.

Butyl Acetate market is balanced and prices are relatively stable although there may be some small increases on the back of propylene increases.

Isopropanol

IPA demand is expected to stabilise n Q2 but prices will increase on the back of propylene. Propylene availability was not yet affecting availability of IPA, but going forward, sources said there could be a bit more pressure as there would be competition between various derivatives for the same propylene molecules. Prices are expected to follow the same pattern as 2013.

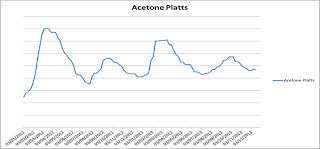

Acetone & Ketones

Acetone market and prices are driven by Phenol production (co-product). Phenol production rates have increased on the back of positive sentiment for Phenol and this will lead to extra Acetone molecules being available. If this is the case, coupled with extra imports, Acetone prices are expected to soften during Q2. Pharmacopeia grade Acetone is said to carry a 10-20% premium over normal-grade acetone.

MEK/MIBK demand has improved. Prices are expected to increase slightly going during Q2.

Toluene, Hydrocarbons and White Spirits

European Hydrocarbons and aromatics will continue to remain volatile and prices could continue on their bumpy road. Lighter crude feedstock into crackers has reduced output and Toluene has been diverted into the gasoline pool for the holiday driving season.

Mono Ethylene Glycol (MEG)

MEG prices have started to slow as the seasonal demand nears and end.

THF (Tetra Hydro Furan)

New capacity in Asia has yet to come on stream. Prices have rolled over and are expected to remain stable during 2014. The new global capacity may lead to price reductions entering 2015.

Acetonitrile

Acetonitrile is a co-product in the production of Acrylonitrile and needs to be purified to remove high levels of Hydrogen Cyanide. This is normally done alongside the Acrylonitrile production unit as crude Acetonitrile is difficult to transport because of the HCN content. Most Acrylonitrile plants actually burn the crude Acetonitrile rather than purify it. Once purified the Acetonitrile output is approximately 2.5-3% of Acrylonitrile output and consequently the Acetonitrile supply/demand balance is totally governed by Acrylonitrile output. Acrylonitrile demand in Asia is very weak resulting in falling prices which will inevitably lead to plants being turned down. This will result in a tightening supply as producers reduce output, which in turn could tighten the Acetonitrile market.

Methylene Chloride

All plants are running normally and no major changes are expected at this time.

AdBlue® Urea Solution and Automotive Products

Urea prices have stabilised/reduced during Q1 and into Q2 as demand is outstripped by global production. Price level of AdBlue® Urea Solution are expected to remain fairly flat.

As mentioned in our previous commentaries, we are producing Adblue® under our BlueCat® trademark. Adblue® is required in all new trucks using SCR technology to reduce Knox emissions. We are the only licensed Irish manufacturer of this product, and we have begun producing product in Australia through a franchise partner.

Other News Items

Brockley Group (Eirchem) now has added TOLUENE from ESSAR OIL (Formerly Shell Stanlow) to their portfolio of products and principals. If you require more information please contact me.

During Q1 2014 several new Brockley developments have come on stream:

¨ Our new AdBlue® plant has been commissioned which will more than double our capacity.

¨ We have moved our depot into a new purpose built warehouse on Johnston Logistics site.

¨ Our new web-based accounts package has gone live.

If you require any product or catalysts, please call us and we will try to source it for you.

Patrick Short

8th April 2014

Best Regards

Pat Short

Brockley Group

Mob: +353 87 2426720

Tel: + 353 1 8392016

www.brockleygroup.com

www.bluecat.ie